Introduction

Starting a business in Cambodia offers numerous opportunities for growth and investment in a rapidly developing market. Due to its easy business setup procedures and thriving economy, Cambodia, with its advantageous location in Southeast Asia, has drawn interest from international investors. It is essential for both foreign and local business owners hoping to establish a reputation for themselves in the community to comprehend this process entirely.

This article provides an extensive overview of the business registration in Cambodia. From initial considerations to selecting the appropriate business structure and the detailed steps required to register your business officially, this guide benefits experienced entrepreneurs and newcomers to the business arena. By the conclusion of this article, you will be equipped to begin launching a thriving business in Cambodia.

Understanding the Cambodian Business Environment

Economic Sectors and Investment Opportunities

Cambodia’s economy is characterized by a dynamic blend of agriculture, industry, and services, providing diverse investment possibilities. With a large percentage of the workforce employed and a substantial GDP contribution, agriculture remains a vital sector of the economy. More recently, there has been a shift towards manufacturing and tourism, fueled by favorable investment conditions and an uptick in foreign direct investment. The government is actively encouraging investments in sectors like textiles, tourism, and real estate by offering incentives to make these industries more attractive to foreign investors.

Regulatory Body and Its Role

The Ministry of Commerce is Cambodia’s key regulator of business activities. This body is charged with registering, overseeing, and supporting all business entities within the country. It ensures compliance with national and international trade regulations and standards. By streamlining the registration process and providing resources, the Ministry significantly aids in the growth and support of businesses.

Legal Frameworks and Economic Policies

Cambodia’s economic policies are designed to attract and support investments. Participation in trade agreements and the ASEAN Free Trade Area (AFTA) makes access to essential markets at lower tariffs possible. Domestically, incentives such as tax holidays, duty-free imports of capital goods, and unrestricted capital repatriation are available, making Cambodia an attractive business destination. The legal environment supports investor rights and aims to provide a conducive atmosphere for business activities, though it continues to evolve, particularly in areas like bureaucracy and transparency.

Benefits of Registering a Business in Cambodia

Legal Protections and Legitimacy

Business registration in Cambodia endows a business with legal recognition, establishing its credibility with customers, investors, and authorities. This recognition protects business owners against personal liability for business debts or legal issues, safeguarding personal assets. Moreover, a registered business can legally enter contracts, acquire assets, and seek legal recourse more effectively than non-formal entities.

Taxation Benefits

Business registration opens the door to numerous tax benefits. Registered businesses enjoy tax incentives that can substantially lower operational costs, including generous depreciation allowances, tax holidays, and preferential treatments in sectors like manufacturing and agriculture. Registration also simplifies the management of corporate taxes, VAT, and other mandatory contributions, ensuring adherence to tax laws and mitigating legal risks.

Access to Finance and Support Services

Registered businesses in Cambodia have better access to financial services. Financial institutions generally require registration documents before offering corporate accounts or credit facilities. This access is essential for funding growth, procurement, and scaling of operations. Additionally, various support services are available to registered businesses, including training programs, subsidies, and grants to foster entrepreneurship and business expansion.

Preliminary Considerations Before Registration

Choosing the Right Business Structure

The first step in Cambodian business registration is deciding on the proper business structure. There are various options, each with unique operational, tax, and legal ramifications, such as partnerships, sole proprietorships, and private and public limited companies. For example, sole proprietorships are more accessible to set up but do not offer personal liability protection, while limited companies, though more complex, provide liability shielding and better capital-raising opportunities. Entrepreneurs must evaluate their objectives, resources, and risk appetite to select a structure that best meets their business needs.

Business Name Selection

Selecting a business name is both a branding exercise and a regulatory requirement. The chosen name should be unique, not already in use, or similar to existing names to avoid legal issues. In Cambodia, the Ministry of Commerce must verify the availability and reserve the name. It should represent the business’s identity and be easily recognizable to potential customers, aiding in marketing and branding initiatives.

Ownership and Legal Requirements

Foreign investors must comprehend local ownership and legal requirements. While many sectors allow complete foreign ownership, some may necessitate local partnerships or specific conditions. Also, knowledge of required permits and licenses for operating in particular industries is vital for compliance with local laws. Depending on the business type, this could include sector-specific licenses, import/export permits, and environmental approvals.

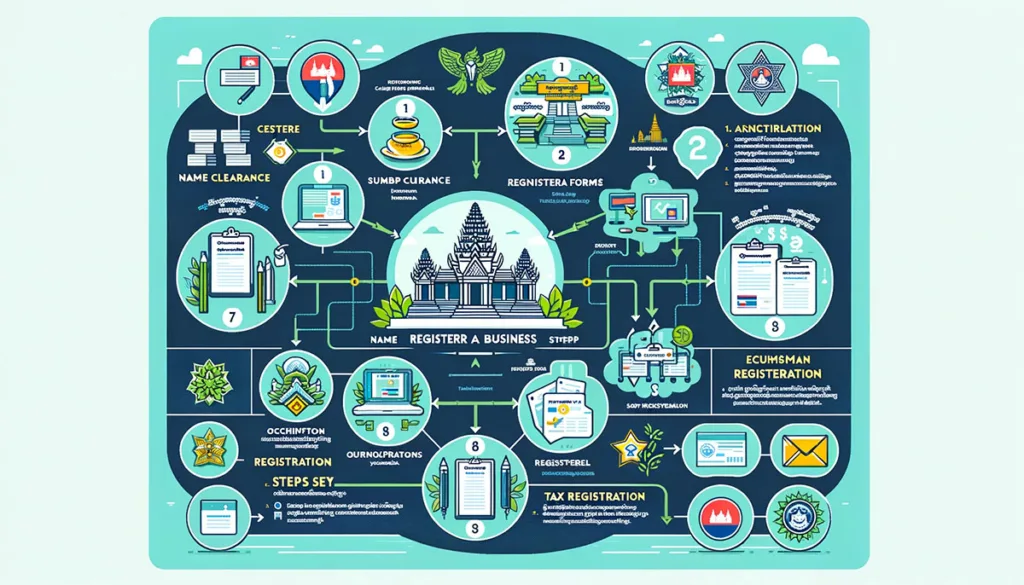

Step-by-Step Guide to Registering Your Business in Cambodia

Step 1: Obtain a Name Clearance Certificate

The initial step in registering your business in Cambodia is obtaining a name-clearance certificate. This step ensures that your chosen business name is not already used or you are not violating trademarks. You can check the availability of your business name through the Cambodian Ministry of Commerce’s online platform. If the name is available, you can secure it by filling out a name reservation form and paying a small fee. This reservation keeps the name for a set period, enabling you to proceed with additional registration procedures.

Step 2: Submit the Application for Business Registration

Once your business name is reserved, the subsequent action is to file a formal business registration application with the Ministry of Commerce. This application should include:

- A filled-out registration form with details like your business’s name, address, ownership, and operations scope.

- Documentation is necessary, such as owner identification, company articles of incorporation (for company registrations), and address proof.

- A payment for the applicable registration fees depends on your business type and size. This step can be completed either through the Ministry of Commerce’s electronic registration system or in person at their office locations. Following submission, the Ministry evaluates your application, a process that may range from a few days to several weeks.

Step 3: Register for Taxes at the General Department of Taxation

After your business registration, you must register with the General Department of Taxation (GDT) to obtain your tax identification number (TIN), which is essential for all business dealings and tax obligations. This registration requires completing a tax form and submitting it with your business registration certificate and other required documents. The GDT then issues your TIN, which is vital for tax filing and compliance.

Step 4: Obtain Necessary Licenses and Permits

Depending on your business type, specific licenses and permits may be required to operate in Cambodia. These could range from health and safety permits to industry-specific licenses and local business permits from city or provincial authorities. Determine all necessary permits for your sector and apply through the respective regulatory agencies. Depending on the industry and relevant laws, this process may take a different amount of time.

Step 5: Register with the National Social Security Fund

In Cambodia, all businesses must register with the National Social Security Fund (NSSF) to provide their employees with health care and occupational risk coverage. This registration involves submitting a form, a copy of your business registration certificate, and an employee list. Registering with the NSSF ensures adherence to Cambodian labor laws and provides social security benefits to your employees.

Step 6: Opening a Corporate Bank Account

To properly manage your company’s finances, you must open a corporate bank account. Select a bank familiar with corporate services in Cambodia. You’ll need your business registration certificate, tax identification number, and personal identification documents to open an account. This account is crucial for handling operations, receiving payments, and meeting financial obligations.

Common Challenges and How to Overcome Them

Administrative Hurdles

A significant challenge in registering a business in Cambodia involves complex administrative procedures and bureaucracy. This can extend timelines and disrupt business plans. To address these challenges, prepare thoroughly with all required documents and clearly understand the process. Engaging a local consultant or legal expert can significantly assist in navigating these procedures and interacting with governmental bodies, thus alleviating the administrative load.

Language and Cultural Differences

Language barriers are significant since most official documents and procedures are in Khmer. Miscommunications can result in documentation errors. Employing bilingual staff or translators can help ensure accurate document completion and submission. Additionally, respecting and understanding local business norms and cultural practices can enhance interactions with local partners and authorities.

Tips for Speeding Up the Registration Process

To accelerate your registration in Cambodia, ensure all documents are complete and correct before submission. Track your application status and regularly contact relevant authorities to promote your application’s progress. Utilizing digital resources for form submissions and status tracking can expedite the process.

Resources and Assistance Available for New Businesses

Government Support Services

The Cambodian government offers multiple resources and support to encourage business establishment and growth. The Ministry of Commerce, the General Department of Taxation, and the National Social Security Fund provide comprehensive guides and online portals with essential information about the registration process. These agencies also organize training and workshops to assist new entrepreneurs in meeting regulatory requirements.

Private Sector and Non-Governmental Organizations

Various NGOs and private-sector groups support new businesses in Cambodia. Business incubators, accelerators, and chambers of commerce provide networking opportunities, mentorship, and financing options. These organizations also host events and training sessions that benefit new business owners.

Online Resources and Local Consultancies

Numerous online platforms and local consulting services offer advice and strategic planning services for additional support. These resources are valuable for navigating the registration process and ensuring compliance with local regulations.

Conclusion

Registering a business in Cambodia requires careful planning and understanding of local regulations but can be successfully managed with proper preparation and support. Following the detailed guide, entrepreneurs can effectively establish their businesses and tap into Cambodia’s growing economic opportunities. Establishing a strong basis for business success in Cambodia can be achieved by having the appropriate tools and taking initiative.

Call to Action

With the knowledge to manage the business registration process in Cambodia, start planning your business setup today. Gather necessary documents, seek expert advice, and use online tools to streamline the process. With every step you take, you are getting closer to achieving your business objectives in Cambodia. Don’t delay—begin your business journey now and embrace the opportunities in one of Southeast Asia’s dynamic markets.

To read more articles, please proceed to Bloghart homepage.