How to Set Your Child Up for Financial Success

In our swiftly shifting economic environment, mastering financial literacy is a crucial skill set for young minds. As guardians, our pivotal duty lies in equipping our offspring with the tools and knowledge for a stable financial voyage ahead. This mission commences not with merely disseminating monetary mechanics but in fostering a profound financial acumen, crystalizing objectives, and embodying fiscal prudence. Herein lies a blueprint to fortify your child’s economic future, laying a robust foundation for their lifelong journey.

Set Goals

Understanding the Importance of Goals

Embarking on the path to fiscal empowerment for your progeny begins with realizing the critical role of goal-setting. Far from mere wishful thinking, goals are the beacon guiding us to our financial destinies. For the younger generation, this understanding transforms the nebulous concept of financial stewardship into a palpable series of achievements, lending money management a sense of purpose and tangibility.

Teaching Goal-Setting Skills

Effective goal formulation begins with acquainting children with the SMART framework—specific, measurable, achievable, relevant, and time-bound goals. This methodology equips them with a lucid blueprint to navigate their economic aspirations.

Consider a scenario where your offspring aims to acquire a video game retailing for $50. Assist them in applying the SMART strategy:

- Specific: Articulate the desire: “I aim to save $50 to purchase the latest video game.”

- Measurable: Establish checkpoints by “Monitoring my savings progress weekly.”

- Achievable: Identify means to reach the target, such as “Undertaking additional chores and allocating my allowance.”

- Relevant: Confirm the goal’s significance, noting, “This game represents a long-cherished desire, promising enjoyment.”

- Time-bound: Set a deadline, “I plan to amass the required sum within two months.”

This technique underscores the essence of foresight and conservation and cultivates a sense of accountability and the meritocracy of aspirations.

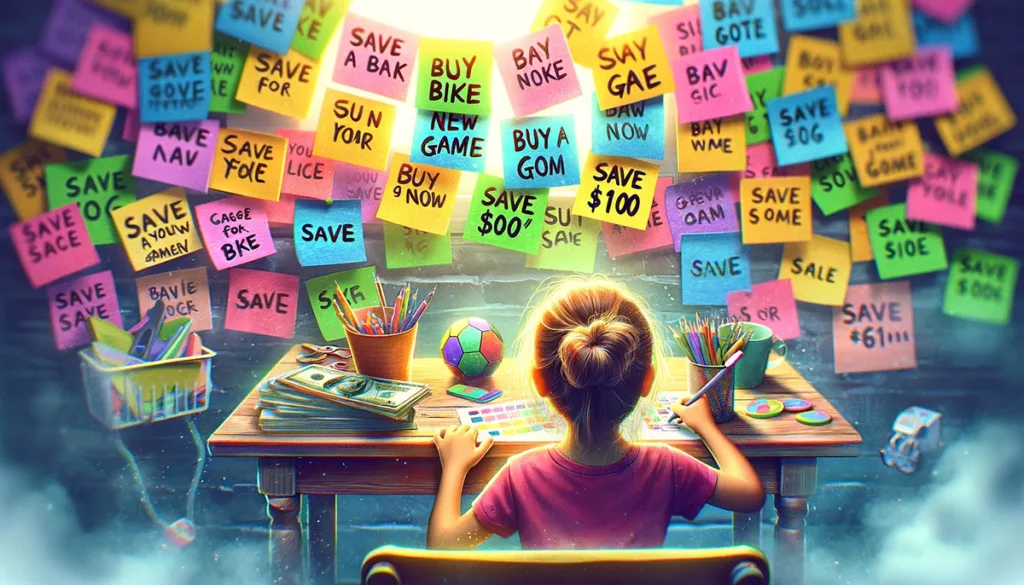

Build a Financial Vision Board

Visualizing Financial Goals

A financial vision board emerges as a potent and imaginative mechanism to drive your child toward their fiscal targets. Acting as a continual visual prompt for their ambitions, it converts vague aspirations into tangible illustrations and motivating affirmations. Whether it’s a depiction of a coveted toy, a montage symbolizing their educational aspirations, or portrayals of long-term dreams such as homeownership, the board brings abstract goals into the physical realm.

Creating the Vision Board Together

Creating a vision board offers a memorable engagement opportunity, reinforcing your bond. It enables your offspring to express their aspirations and comprehend the power behind visualizing their objectives. Gather essential materials like a poster board (or opt for a digital variant), magazines for cutouts, markers, and stickers. Encourage imaginative thought and the inclusion of both near-term and distant financial goals.

Empower Goal Achievement

Providing Tools and Resources

Equipping your child to realize their financial ambitions necessitates furnishing them with practical instruments and resources. Initiating a savings account in their name can serve as an introductory lesson in banking operations, interest accrual, and the virtues of saving. Moreover, acquainting them with budgetary applications and fiscal games tailored for youth can make learning fun and instructive.

Encouraging Financial Education

The cornerstone of economic triumph lies in education. Propel your child toward financial literacy via diverse channels—jointly exploring literature on fiscal management, partaking in seminars or digital forums geared towards young savers, and weaving money-related dialogues into dinner discussions. Embedding financial literacy into daily conversations exposes them to pragmatic, relatable fiscal lessons.

Lead by Example

Modeling Financial Behavior

Imparting financial wisdom is most effective through demonstration. Children, keen observers by nature, often mimic parental conduct. Exhibit prudent financial practices: budget with care, save with consistency, invest wisely, and spend judiciously. Witnessing responsible money management firsthand instills in them the significance of fiscal discipline.

Sharing Financial Experiences

Your fiscal journeys—triumphs or educational setbacks—constitute invaluable teaching moments. Narrate how you accrued funds for your first automobile, navigated initial credit card blunders, or meticulously planned a family getaway. Such real-life anecdotes demystify financial concepts, illustrating that fiscal stewardship is an ongoing educational journey with growth prospects.

A Final Thought…

Preparing your progeny for financial prosperity is a comprehensive endeavor extending beyond the rudimentary comprehension of currency. It encompasses nurturing a goal-oriented mindset, appreciating the efficacy of goal visualization, acknowledging the pivotal role of education, and setting a parental example. By ingraining these principles during their upbringing, you do more than merely prepare them for sound financial management; you empower them to realize their dreams. The overarching objective is to foster financial confidence and autonomy in your child, crafting a foundation for a flourishing and stable future.